Long Term Plan 2024-2044 Consultation

Published on March 15, 2024

What is the Long Term Plan?

The Long Term Plan (LTP) sets our direction for the next 20 years – outlining our activities and providing a long term focus for decision making. It’s an important mechanism which strengthens long term planning, community consultation and participation, and accountability.

This plan:

- Describes the type of District our communities have told us they want – our community outcomes.

- Details the services and key projects we plan to deliver over the next 20 years to deliver on these community outcomes.

- Outlines the cost of delivering these services and how they will be funded.

Why have a Long Term Plan?

Under the Local Government Act 2002 we have to develop a LTP every three years with full consultation of our community each time. The LTP is also an important process which gives our community the opportunity to have a say on where we are heading so it is developed together, and to ensure our planning is robust.

How it’s developed and how you can be involved

The process for developing our LTP is outlined below. Currently, we are in the formal stage of the consultation process, where we’re seeking your input into our draft LTP.

TOPIC #1

He aha ngā momo ratonga mō tō tātou hapori?

What services do we need for our community?

|

|

Unlike other councils who may have a port or an airport to augment their income, rates continue to be our main source of income and now make up just over 80% of our operating income.

The decision to propose a significant rate increase is not one we take lightly, especially under the current circumstances. Yet, to maintain the levels of service our community is accustomed to, we’re looking at a substantial rate increase. We’ve started re-evaluating everything from scratch, scrutinising our operational costs and exploring every opportunity to make significant reductions. We are working hard to find operational savings across the board, but to just cover cost increases like interest, depreciation, insurance and utilities, we’re looking at an average rates increase of 14%. But to fully manage the increasing costs of operating a business, while maintaining current service levels, we’re actually facing the need for an average rates increase of 23.6%.

The weight of proposing a significant rates increase was difficult for Elected Members, made worse by the ever-rising costs many households are experiencing, and our district having a disproportionately lower than average household income compared to the rest of New Zealand.

Visit our Rating Database to calculate the impact of the preferred option on your rates.

How the impacts of other consultation questions are worked into the rates figures

The figures you get from the Rating Database calculator all include each of the ‘preferred options’ for questions we are consulting on about managing waste and how costs are shared. They don’t need to be added in. (By law we have to identify ‘preferred options’ and to create a draft budget, but that doesn’t mean Council has already decided on the issues.)

What that means

| Option 1 – you’d see no reductions or stoppages of services you receive but this would be an average 23.6% rates increase and it isn’t Council’s preferred option |

| Option 2 (preferred option) – To reduce the rates increase to an average of 17.4% |

| The changes you’d see are: |

Savings in $ terms |

Savings as % rates |

| Removing fund for Adverse Events/Emergencies |

$200,000 |

0.4% |

| Increasing fees (by higher than the average) to meet Revenue and Financing Policy target for Animal Control and other minor changes across the organisation |

$100,000 |

0.2% |

Closing Te Takeretanga o Kura-hau-pō, the Youth Space and Te Awahou Nieuwe Stroom on Sundays.

*Tell us if you think there might be other ways we could save the required funds across facilities, without having to close on Sundays. |

$77,000 |

0.1% |

| Increasing parking meter fees from $1.10 to $2.00 to increase revenue |

$100,000 |

0.2% |

| Council will sell half our Carbon Credits to lower the rates increase (included in the 17.4%) |

$450,000 |

0.9% |

| Increasing Trade Waste Levies |

$214,000 |

0.4% |

| Stop Urban berm mowing |

$240,000 |

0.5% |

| Reduce Council's investment in Waste Minimisation activities |

$100,000 |

0.2% |

| OPTION 3 - For an average rates increase less than 17.4%: Includes all changes in Option 2, and asks which of the following you’d support |

| Which of the following you’d support? |

Savings in $ terms |

Savings as % rates |

| Slowing down our work on implementing our affordable housing action plan |

$90,000 |

0.17% |

| Reducing our investment in economic development for the district |

$200,000 |

0.38% |

| Continue to partially fund recycling through debt |

$625,000 |

1.2% |

| Remove funding for community development. This includes removing community grants and funding |

$945,000 |

1.8% |

| Reduced investment in information services |

$176,000 |

0.3% |

| Reduce the level of rates funded depreciation |

$140,000 |

0.3% |

| Reduce investment in roading |

$400,000 |

0.8% |

Note - the impacts of this option on rates for each property and on Council’s borrowings will depend on the reduction in rates expected.

View Topic 1: What services do we need for our community?

TOPIC #2

Te Whakahaere Para

Managing Waste

|

|

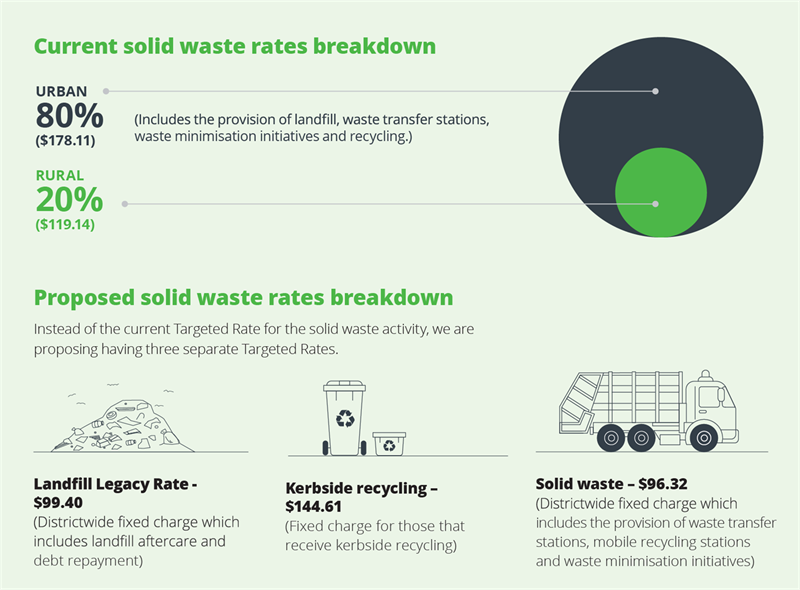

Effective waste management for our district requires a bit of a reset. We’ve closed the Levin Landfill, but there are ongoing costs associated with managing the closed landfill as well as landfill debt. We’re proposing to share the solid waste rates including kerbside recycling in a more sustainable and equitable way.

Landfill legacy rate – Levin Landfill aftercare and landfill debt

Our closed landfills require careful ongoing monitoring and maintenance, especially the Levin Landfill, which needs monitoring and maintenance for a minimum of 30 years. To cover these costs, a ‘Landfill Legacy Rate’ is proposed to be introduced. This rate will allow us to repay the existing landfill loan of $4.7m and fund the ongoing monitoring and maintenance of our closed landfills. We would have ideally paid for this in the past but we haven’t yet. As all residents are likely to have benefited from the landfills in some way, the cost will be evenly shared among all properties in the district, with the loan being serviced over the next 20 years.

| Option 1 (preferred option) - Repay through Targeted Rate |

|

Create a separate Targeted Rate to repay the landfill loan and pay for aftercare. Everyone will pay the same.

As residents of the district benefited from the landfills, the cost will be equally distributed across all properties. Regardless of the size, value or use of your land, everyone would pay the same amount.

|

| Option 2 (status quo) - Repay through Solid Waste Targeted Rates |

|

Repay the landfill loan and pay for aftercare through the current solid waste Targeted Rates.

|

For a summary of the advantages and disadvantages of each option and the impact on cost, rates and debt visit letskorero.horowhenua.govt.nz/LTP2024-44

Delivery of kerbside recycling services

Questions:

- How should we fund kerbside recycling services?

- Who receives it?

Currently Council provides a fortnightly kerbside recycling service to urban properties. The situation for rural properties is less straightforward. Residents who receive the rural kerbside recycling service have never fully paid for the collection and there is no defined extent (or boundary) of the rural service.

A decision needs to be made to either remove the service or determine if there is a workable and fair way to rate some or all rural residents for the service.

A further complexity is that not all rural properties receive the kerbside recycling service. Those that do were offered the service during its inception if they already had a private commercial rubbish bin collection service in place.

This service is funded through the Solid Waste Targeted Rate. This rate has three components: kerbside recycling, waste disposal operations such as the transfer station and maintenance of the closed Levin Landfill. We are splitting the rate into the three parts so it is clearer who is being charged for what and to more appropriately share the costs.

There are four options below to show how this could be managed.

| Option 1 (status quo) - Urban continues to pay, some rural properties subsidised to receive the same service |

|

This option proposes that we would continue with our current approach to service delivery. This means to continue the service to existing urban and rural properties. This includes only offering new properties in urban locations kerbside recycling.

Rural properties currently receiving the service, and provided it is deemed safe to do so, would continue to receive the service with no contribution towards recycling (they do however continue to pay the rural portion of the solid waste rate).

|

| Option 2 (preferred option) - Transition to a Targeted Rate for kerbside recycling |

|

Urban and Rural share the costs evenly to continue receiving recycling services.

This option proposes to keep the waste service delivery as it is until 1 July 2026 only, recognising that this approach isn’t aligned with the best practice for rating models (risks set out below). During this period, we would continue the kerbside recycling service for both existing and new properties in urban and rural areas currently receiving the service, provided it is safe to do so.

|

| Option 3 - Urban only kerbside recycling from 1 July 2026 |

|

Urban continues to pay and only Urban receives the service

This option could only take effect from 1 July 2026 when the existing service contract ends. The services include removing the existing rural service to the 2,200 properties that currently receive the service. This option sits within the Ministry for the Environment (MfE) guidelines and allow the benefits of a new contract tailored to kerbside recycling only to urban areas.

|

| Option 4 - Removal of Kerbside Recycling in the district from July 2026 |

|

This couldn’t come into effect until 1 July 2026 as we have a Kerbside Refuse Collections contract that continues to mid-2026. This option is included because affordability is a key factor in providing services within the district.

We anticipate our district would require the implementation of five additional Mobile Recycling Stations to manage demand. (i.e. towns of 1000 people or more) by 1 January 2027” .

|

View Topic 2: Managing Waste

Managing and minimising waste

The government requires all councils to produce a waste management and minimisation plan (WMMP). The plan helps us to comply with legislation and access waste levy funding from the government. As part of this consultation, we are asking you to provide your input into our draft Waste Management and Minimisation Plan 2024.

Read the draft WMMP

TOPIC #3

Te toha utu – mā wai ngā

Sharing costs – Who should pay for what?

|

|

As with solid waste, part of Council getting the basics right, and sharing costs fairly, we’re proposing to change how we share rates for the Te Awahou Foxton Community Board, and Economic Development. We’re also proposing changes to our Rates Remission Policy.

Te Awahou Foxton Community Board Rate

Te Awahou Foxton Community Board (TAFCB) represents its local community and advocates to Council about local issues, including public transport and facilities such as libraries and parks.

The Board has six members; five members elected by Kere Kere Ward voters, and one councillor appointed by Horowhenua District Council.

The Board receives $188,000 in funding from Council, paid for by rates each year.

| Option 1 (status quo) - Fund through Representation and Community Leadership Targeted Rates only |

|

All Horowhenua rate payers fund TAFCB through Representation and Community Leadership Targeted Rates.

This option involves no changes, meaning everyone in the district will continue to pay equal amounts to fund TAFCB.

|

| Option 2 (preferred option) - Fund through new Targeted Rate |

|

Foxton and Foxton Beach residents pay a Targeted Rate to fully fund the costs for TAFCB.

This option proposes that Foxton and Foxton Beach properties (within TAFCB electorate) will pay a separate fixed Targeted Rate to fund TAFCB as they are intended to be better represented by having this in place compared to the rest of the district.

|

View Topic 3: Sharing costs – who should pay for what?

Economic Development Targeted Rate

The economic development funding covers business support and advice provided to existing businesses, Iwi and Māori economic development, inward investment, training opportunities, communications, and provision of economic data.

Currently, economic development is funded entirely through the districtwide General Rate, with the costs shared across all ratepayers.

| Option 1 (status quo) - Fund through General Rate |

| Economic Development is funded through the General Rate, meaning costs are shared across everyone based on the land value of their property. |

| Option 2 (preferred option) - New Economic Development Targeted Rate |

| Targeted Rate based on capital value from properties identified by QV as either commercial, utilities, industrial or mining, which is currently funded by General Rates. |

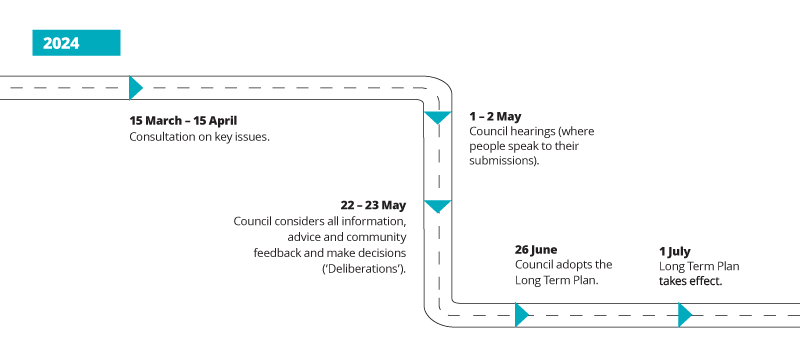

Long Term Plan Key Dates

Me pēhea rā koe e whai kōrero ai

How to have your say

Kōrero Mai

It’s easy to ask questions and share your thoughts with us. Submissions close 15 April 2024. Council will receive the formal submissions and other feedback received, including comments from social media, ahead of Council’s decision making.

In person

Speak to one of our Council Officers on 06 366 0999 or talk to Elected Members face to face at one of our events or workshops. A full list of events and workshops is available on letskorero.horowhenua.govt.nz/LTP2024-44.

Drop into a Cuppa with a Councillor session at Te Takeretanga o Kura-hau-pō, Te Awahou Nieuwe Stroom or Shannon Library to learn more about the Long Term Plan, share your views and get help to make a submission.

- Thursday 21 March 10.30am

- Thursday 28 March 10.30am

- Thursday 4 April 10.30am

- Thursday 11 April 10.30am

Making your submission on paper

Submissions can be delivered to:

Horowhenua District Council Offices

126 Oxford Street, Levin

Te Takeretanga o Kura-hau-pō

Bath Street, Levin

Te Awahou Nieuwe Stroom

92 Main Street, Foxton

Posted to:

Horowhenua District Council

Private Bag 4002

Levin 5540